12 Banks With Free Checking Accounts With No Deposit

Banks With Free Checking Accounts With No Deposit – In 2017, several digital banks gained popularity after traditional banks extinguished their tax-free alternatives. We have already analyzed NuConta and Next , from Bradesco, but there are several other alternatives.

Currently, it’s very easy to avoid paying fees like account maintenance and transfers, like TED and DOC – imagine how much you can’t save by not paying those fees. Here are some trusted virtual banks Checking accounts that With No Deposit free:

12 Banks With Free Checking Accounts With No Deposit June 2021

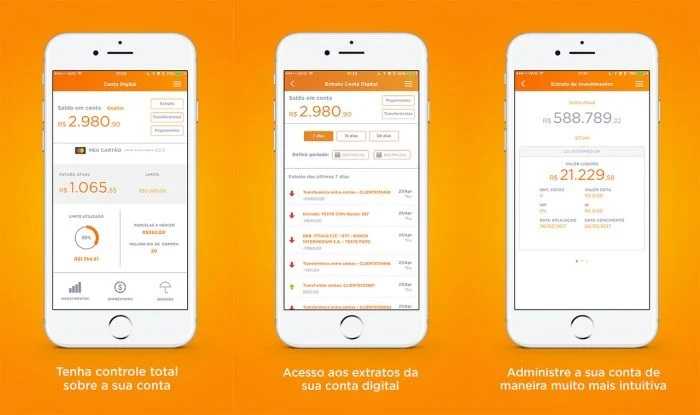

1. Banco Inter

One of the most popular – and formerly called Intermedium – Inter has existed since 1994, but has modernized well to meet the demands of banks with digital accounts. Inter’s account is practically free of charge and comes with a MasterCard debit card for purchases and withdrawals from 24-hour ATMs.

The cool thing is that you can transfer your money to Inter without paying fees by paying a boleto. You enter the amount in the app, set the salary and can pay the way you prefer.

Inter also offers some investments, such as CDB, LCI and LCA, in addition to a credit card (upon analysis) that has no annual fee. The bank also recharges cell phones, loans and accepts deposits by check (scanned).

In addition, there is the Digital Account PJ , for companies, and the Digital Account for MEI , both include up to 100 TEDs and 100 free slips per month, and do not charge fees. Download the Inter app on Android or iOS .

2. Agibank

Another option, closer to Banco Inter, is Agibank, which has a Banks With Free Checking Accounts With No Deposit to loans, insurance, consortia and investments. The account comes with a credit and debit card.

There is no maintenance fee, but withdrawals, transfers, deposit by boleto and credit card are exempt for a certain period. These are the values that take effect from June:

- withdrawals on 24h networks : 2 withdrawals per month (after R $ 6.49 per withdrawal);

- transfers : 4 TEDs per month (after R $ 1.90 per TED);

- paid slips : 4 slips per month (after R $ 2.99 per slip);

- credit card : exempt monthly fee in the first year (after R $ 12.99). If you spend 50% of the limit in the month, have an invoice greater than or equal to R $ 500 and invest at least R $ 5,000 with Agibank, you can keep the exemption.

Agibank offered the type of business accounts, including for MEI, apparently the service was no longer offered, not even being found on the bank’s help pages.

Read Also: 10+ Free Online Business Checking Accounts

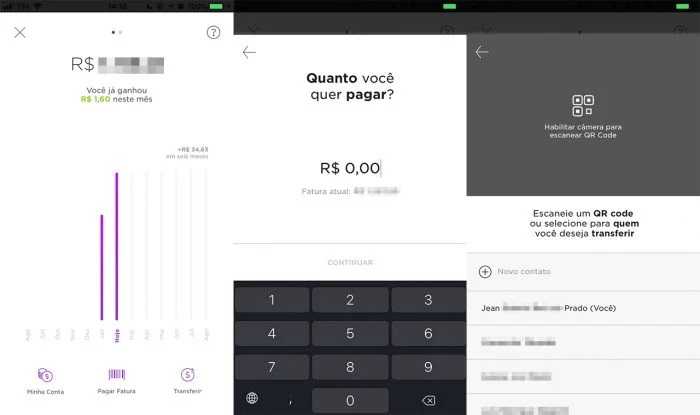

3. Nubank (NuConta)

We have already done a very thorough analysis of NuConta . Basically, it is a payment account that makes your balance pay off at a rate very close to the Selic rate. As Nubank himself explains, “the money deposited is separate from Nubank’s assets and can only be used for applications in Federal Government Bonds”.

You can make transfers from NuConta without paying anything, and you can also pay collection slips (without IPVA or IPTU, however). And, of course, you can pay your Nubank card bill (and the app recognizes it almost instantly).

For now that’s it. You don’t have a debit card, you can’t withdraw money (just by credit, but there is an IOF) or schedule transfers, for example. Overall, NuConta is still quite incomplete to be your primary account, but it is a good second option, even for emergency booking.

The good news is that you don’t need a Nubank card to use NuConta. You can order yours on this page and download the Nubank app for Android or iOS .

4. Modalmais

The Modalmais is also a With Free Checking Accounts With No Deposit and transfers. However, it is geared to an investor profile, with a more complete investment catalog: Fixed Income, Direct Treasury , Investment Funds, COE, Incentive Debentures, Shares , BM&F mini-contracts and IPO / OPA public offers.

This may not be an online bank for all types of people, but anyone who likes to invest can be a good choice. Modalmais includes in the free plan the trading platform Meta Trader 5.

Read Also: 100+ List Free Paypal Account Email And Password

5. Banco Next

We already talked about him in this post . Basically, Next is a virtual bank subsidized by Bradesco, but which tries to attract young audiences and those interested in digital accounts. Recently, he launched a checking account with no fees and became much more interesting.

Next’s basic plan gives you access to 1 TED / DOC per month, unlimited withdrawals, Visa International credit card with no annual fee (for now) and travel assistance. In addition, it has cool features like Flow, Vaquinha, Objetivo and Mimos.

The latter is more interesting: just by having an account with Next, you get a discount of R $ 20 on Uber, 5% on Airbnb, 50% on Cinemark and several other services.

Read Also: Free Netflix 2020 Premium Account and Password Generator

6. Neon Bank

Another digital bank is Neon , which offers a banks with free checking accounts with no deposit or maintenance fees. Transfers to other Neon accounts are unlimited and there is no fee for the first transfer, deposit via boleto and withdrawal on the 24-hour network. After that, the amount of each transfer is R $ 3.50, deposits of R $ 2.90 per bank slip and withdrawals of R $ 6.90.

To gain exemption on the next transfers and deposits by boleto, the bank has the Neon + mode, which can be activated after the customer has made 10 purchases on the account. The exemption period is valid for 30 days, renewing whenever there are 10 purchases within the 30-day period.

In addition to a credit card with no annual fee, Neon also has an account for legal entities (including MEI) and investment functions: the Objectives program helps the client to collect money, with scheduled installments or sporadic deposits; and CDB investment that yields 95% to 101% of the CDI.

7. Superdigital

Subsidized by Santander, Superdigital can be a bank without fees, as long as the customer spends at least R $ 500 on the prepaid card, which automatically debits the amount spent from the accounts. The plan itself costs R $ 9.90, but if there is no such amount in the accounts, it will not be charged and the user will not be negative.

The plan includes one transfer per month, one withdrawal and two deposits per ticket; after that operations will be charged.

8. Sofisa Direct

Sofisa Direto has a completely banks with free checking accounts with no deposit, with no maintenance fee, withdrawal or TED / DOC. He offers a MasterCard credit card that charges the amount directly from your account.

Sofisa Direto offers deposit by boleto, in addition to TED and DOC options. However, withdrawal is limited to four transactions per month. The bank also offers payment and scheduling of slips, in addition to having an investment section that is even attractive, with CDBs that yield 100% of the CDI and have daily liquidity.

As Sofisa Direto is part of Banco Sofisa SA (specializing in credit for small and medium-sized companies), it also makes loans to users.

Read Also: 100+ Clash Royale Free Accounts 2020 Email And Password

9. Pag!

The Pag! belongs to the Avista Group and offers a Mastercard credit card with no annual fee and a digital account without fees, forever. It is possible to make transfers to any bank and make withdrawals on networks 24 hours at no cost.

It is one of the simplest and as everything is free they allow the customer to pay what they think the services are worth, even so, it is possible to use everything at no cost.

10. Banking, do Insurance

Launched in May 2019, PagBank can be opened by Android and iOS applications within 3 minutes, as promised. Those who have an account on the service already automatically have a PagSeguro banks with free checking accounts with no deposit, just enter the platform and check the branch and account number.

PagBank includes five free TEDs per month for other banks, after which R $ 1.99 will be charged for each TED. For other PagBank customers, transfers are unlimited between them. Withdrawals from the Banco24Horas chain cost R $ 7.50. Deposits by bank slips are unlimited.

An international prepaid card with Visa is also offered to customers without annual fees. It works in credit mode and can make payments via NFC at compatible terminals. As it does not function as a debit card, the card needs to be topped up and, according to PagSeguro, the money must fall within one hour on the card.

11. C6 Bank

The C6 Bank has also become popular with the free digital accounts. In addition to unlimited TEDs and withdrawals, the credit and debit card is already enabled with payment by approximation. To customers, the bank also offers the C6 Taggy, a stripe to pay tolls (like a Sem Parar) with automatic debit to the account.

Among other resources, C6 Bank also has a digital account for MEI (Individual Microentrepreneur), with up to 100 free TEDs per month (afterwards R $ 4 per transaction is charged) and unlimited withdrawals.

There is also the Global Accounts (dollar account), which allows you to convert an amount in reais, from the main account, to dollars, in the global account. Then, just use the international debit card abroad normally, at lower rates and with a commercial quote. There is a $ 30 fee for opening and issuing the global account card.

Read Also: 150+ Free Roblox Accounts

12. Bank BS2

The BS2 Bank is the former Banco Bonsucesso. The banks with free checking accounts with no deposit: transfers (TEDs), withdrawals on the Banco24Horas network and unlimited slips. The card is already enabled with NFC technology for payment by approach.

BS2 was the first to launch a free dollar accounts and, unlike C6 Bank, there is no opening fee. However, in order to issue the international card, it is necessary to have traded at least $ 30 in the account. To request this service, you must have a digital account first, and then request the international account.

What banks with free checking accounts with no deposit?

It is increasingly easy to find banks with free checking accounts with no deposit, including those in the country’s traditional financial institutions, such as Banco do Brasil and Caixa com Conta Fácil, but the movement is limited to R $ 5,000 or R $ 3,000 per month and withdrawals (from the fifth) and transfers to other banks are paid, so it ends up not paying off.

In the past, Banco do Brasil had BB Conta Eletrônica, a fee-free service for any transaction through digital channels. It is not possible to open this account anymore, instead the bank migrated to the Easy Account, more limited.

Itaú offered iConta: it was an entirely free category and the customer had transfers to any bank and unlimited withdrawals, without charging fees. However, he did not have the assistance of a manager at the agency. The modality was also discontinued.

Bradesco offered DigiConta, with the same benefits as Itaú’s iConta and BB Conta Eletrônica (all unlimited and without charging fees for handling by electronic means), but the institution ended the service to invest in new technologies (and there came the Next).